Last updated: 20240319As we are nearing the end of the year, this is an opportune time to ensure our plans are now in place for improving trading results moving forward.

Last updated: 20240319As we are nearing the end of the year, this is an opportune time to ensure our plans are now in place for improving trading results moving forward.

Last updated: 20240729I was an eager trading upstart with a few trading profits from the dot com boom way back before the year 2000. I chucked in my job, sold

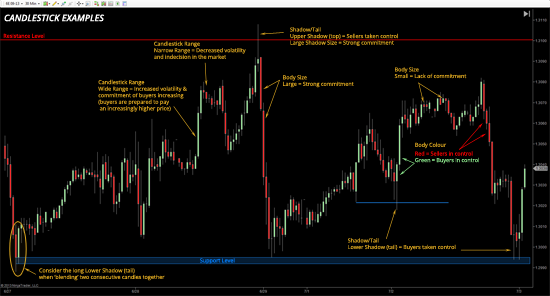

Last updated: 20250619Bar chart vs Candlestick chart Although bar and candlestick charts both display the same information (high, low, open, and close for a specified period), with bar charts the

Last updated: 20250607What are your barriers to trading success ? Many new traders can easily get caught in the trap of focusing more on their winning percentage (accuracy) or entry

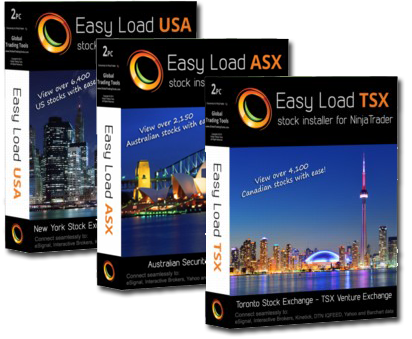

Last updated: 20240729Managing your Australian Securities Exchange (ASX) stock portfolio is easier than ever before.You won’t believe how easy it is to now view ALL of your favorite ASX stocks

Last updated: 20250607This simple yet effective trading strategy aims to capture the movement out of a contraction area into an expansion area. Trading strategy components Although classed as a “simple”

Traders Boardroom special presentation topics over the last week… “Analysis of ’12 million live FX trades’ article and key mistake traders made” by Stuart Young “Davin’s Trade Setup Review &

This weeks Traders Boardroom special presentation topics… Trade Review Session with Davin Clarke – 6th Feb 2013; and Record Keeping and Trading Journal Spreadsheet (TJS) – Part3 (Advanced Reporting) with

On Wed 6th February, Royal Bank of Scotland (RBS) became the third bank to pay fines in the Libor scandal… but what is Libor & the rate fixing scandal all

Last updated: 20231230This weeks Traders Boardroom special presentation topics… Market Structure – Action & Reaction Moves; and Market Structure – Early Sequence Trades (6A AUD) with TMR are now available

Please join our email list to receive notifications of new trading software releases, strategies and tips for traders of all levels.

Global Trading Tools aims to not only bring you leading-edge trading tools developed and used by full-time traders, but to equip you with the experience and confidence required to succeed in this challenging industry

Global Trading Tools is NOT a Broker Dealer or a Registered Investment Advisor (RIA). Global Trading Tools provides trading tools and engages in trader education & training.

The webinars, seminars and online training courses given by Global Trading Tools are for educational purposes only. This information neither is, nor should be construed, as an offer, or a solicitation of an offer, to buy or sell securities. You shall be fully responsible for any investment decisions you make, and such decisions will be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance, and liquidity needs.

* Testimonials displayed on GlobalTradingTools.com may not be representative of the experience of other customers/clients, and is not a guarantee of future performance or success.

# Trading in Futures, Options, Currencies, Financial Spread Bets, CFDs or any other derivatives, carries a high risk of losing money rapidly due to leverage. You must be aware of the risks involved and be willing to accept these risks in order to invest in these markets. Do not trade money you cannot afford to lose. You should consult with your own licensed financial adviser before You make any decision on the basis of any products, services or information Global Trading Tools may provide.

The past performance of any trading system or methodology is not indicative of future results. View Full Risk Disclosure

CFTC RULE 4.41 Hypothetical or simulated performance results have certain inherent limitations, unlike actual performance records: simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under or over-compensated the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No presentation is being made that any account will or is likely to achieve profits or losses similar to those predicted or shown.