Last updated: 20240729

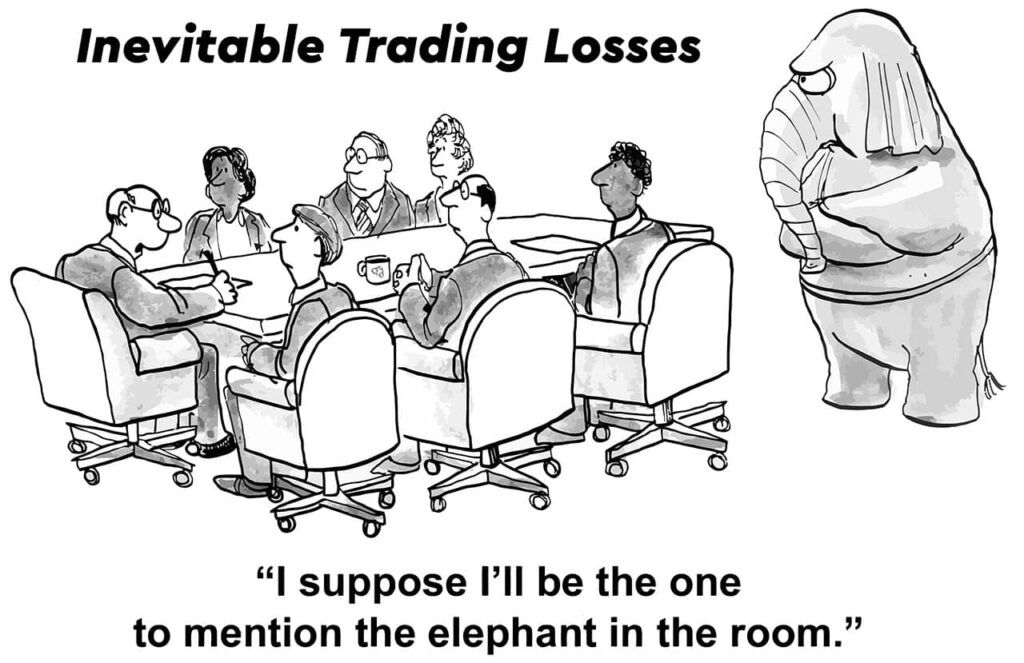

I came by a book published around 80 years ago by R.W. Schabacker. It is amazing that even without the HFT systems, chart patterns and business channels devoted to trading and investing that the core concepts remain. Losses are inevitable.

It is how we deal with them that is key.

No trader can ever expect to be correct in every one of his market transactions. No individual, however well he may be grounded, no matter how much experience he has had in practical market operation, can expect to be infallible.There will always be mistakes, some unwise judgments, some erroneous moves, some losses. The extent to which such losses materialize, to which they are allowed to become serious, will almost invariably determine whether the individual is to be successful in his long range investing activities or whether such accumulated losses are finally to wreck him on the shoals of mental despair and financial tragedy.It is easy enough to manage those commitments which progress smoothly and successfully to one’s anticipated goal. The true test of market success comes when the future movement is not in line with anticipated developments, when the trader is just plain wrong in his calculations, and when his investments begins to show a loss instead of a gain. If such situations are not properly handled, if one or two losing positions are allowed to get out of control, then they can wipe out a score of successful profits and leave the individual with a huge loss on balance.

It is just as important, nay, even more important, to know when to desert a bad bargain, take one’s loss and count it a day, as it is to know when to close out a successful transaction which has brought a profit.

The staggering catastrophes which ruin investors, mentally, morally, and financially, are not contingent upon the difference between a 5 per cent loss limit and a 20 percent loss limit. They result from not having established any limit at all on the possible loss.

Any experienced market operator can tell you that his greatest losses have been taken in those, probably rare, instances when he substituted stubbornness for loss limitation, when he bought more of a stock that was going down, instead of selling some of it to lighten his risk, when he allowed pride of personal opinion to replace conservative faith in the cold judgment of the market place.

We trade to make a profit.

— Written by Schabacker 80 years ago in Stock Market Profits.

Thank you and good trading.

Davin & Stuart

You understand and acknowledge that there is a high degree of risk involved in trading securities, currencies/foreign exchange and/or derivative products. Trading securities, currencies/foreign exchange and/or investment in derivatives can be very speculative, involves considerable risk, may result in losses and is not suitable for every investor. Global Trading Tools does not take into account the objectives, financial situation or needs of individual users. Hence, You should carefully consider whether trading in securities, currencies/foreign exchange and derivative products is appropriate for You in the light of your financial circumstances. You should be aware that dealing in products that are highly leveraged carry significantly greater risk than non-geared investments such as share trading. As such, You could both gain and lose large amounts of money. You may sustain losses in excess of the moneys You initially deposit and also in excess of the margin required to establish and maintain any positions in leveraged products.

No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any form of media (including but not limited to web sites, email, print or banner advertising, social media sites and/or Global Trading Tools affiliates) by Global Trading Tools.

The past performance of any trading system or methodology is not indicative of future results.

THIS ARTICLE IS FOR EDUCATIONAL PURPOSES ONLY.